Risk Management

Optiva LCS Hellas offers Financial Risk Management solutions. Through our services, financial institutions gain a centralized view of risk, liquidity, capital and profitability across the enterprise so they can be prudent in their decision making, yet strategic for maximized returns.

We are confident that our clients can build or improve their risk management framework, including the right set of Key Risk Indicators (KRI), along with the processes and systems to enforce them. Our experience can help in order to transform the available data into valuable information that will help our customer make the right decisions.

Achieving operational efficiency with effective compliance and risk functions is critical to a modern, competitive payment operation. Electronic transaction volume growth, new regulations and the trend toward real-time processing provide a considerable challenge to achieving operational efficiency, including efficient operational liquidity management. The most particular cases for risk management are sanctions, anti-money laundering (AML) and fraud detection.

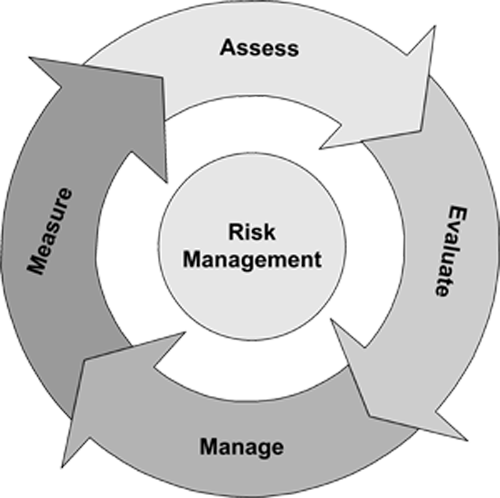

We believe that the figure aside is the most representative and reflects our culture and our strategy concerning risk management over a financial institution with the best way possible.

For us, four steps are required in order to achieve in risk management. First, risk should be measured, then we assess risk in order to develop and evaluate strategies which will be able to help in managing it, which is the final step.